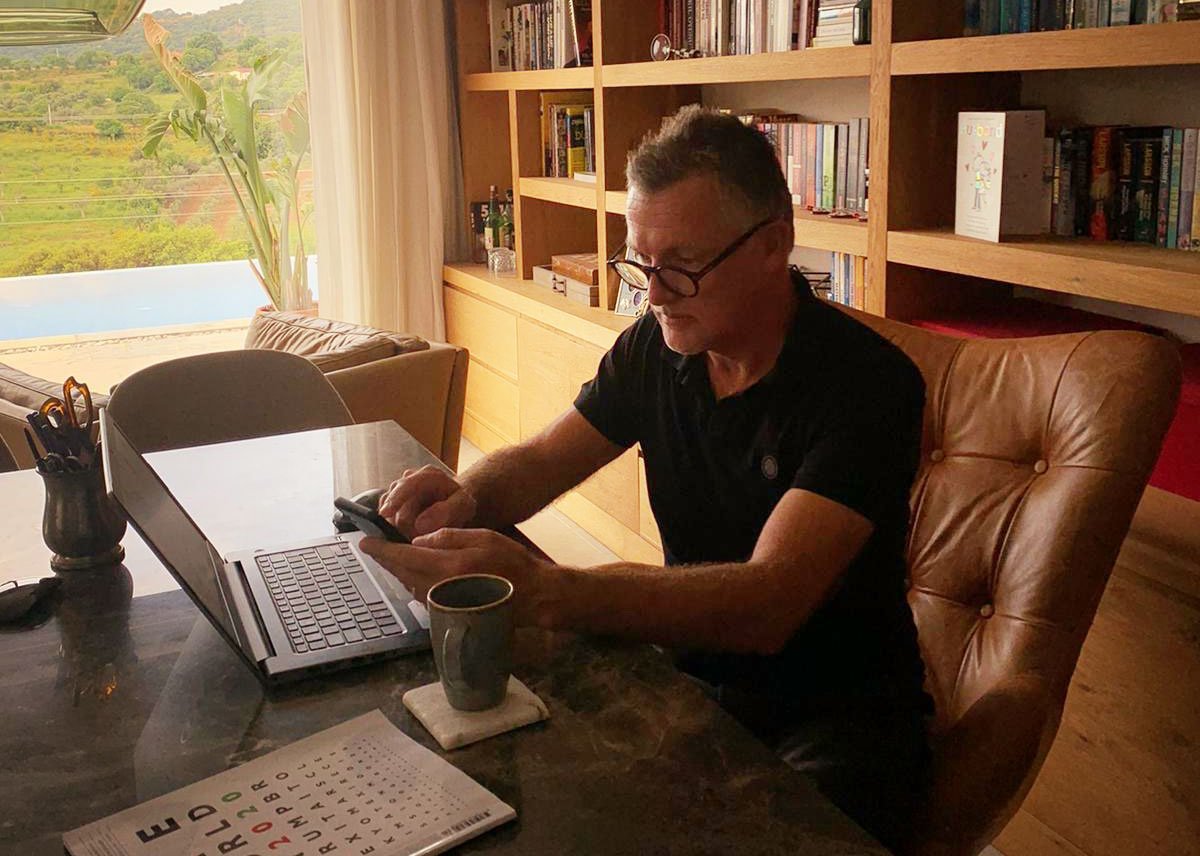

Luxury Property Turkey has received a flurry of enquiries this week regarding the decline of the Turkish lira in mid-August, 2018, and LPT Founder Darren Edwards explores the reasons behind the fall, and how such currency fluctuations can serve as excellent investment opportunities, especially for contrarians.

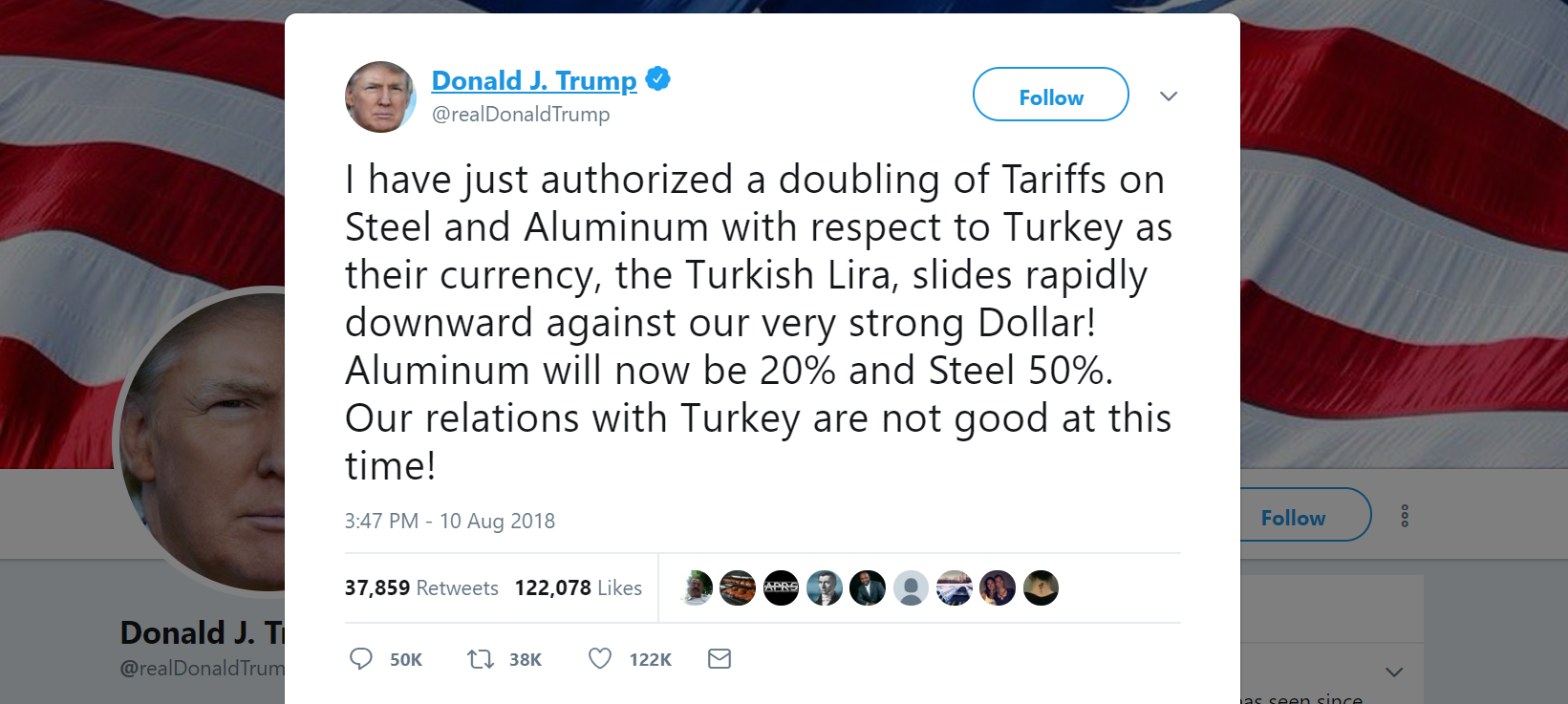

The lira took its biggest hit last Friday, 10 August, 2018 following Trump’s notorious taking to Twitter.

In contrast to Donald Trump’s no-win strategy, members of the EU are standing behind Turkey’s currency crisis, preferring to see a strong and successful Turkey. The reasons for this are that the EU has huge investments in the Turkish banking and various economic sectors, and needs a vibrant future for the country. In any event, the fluctuations make an interesting environment for foreign investors to make use of their strong currency against the Turkish Lira.

Baron Rothschild, who made a fortune following the Battle of Waterloo, famously said, ‘’The time to buy is when there is blood in the streets.’’ Yes, even if the blood is your own! If you follow the crowds and place your money where most people are, it’s probably not a high-return investment.

So where are investors putting their hard currency in Turkey? Muyar and İska Construction Board Member Yasin Erol noted that it is a very convenient time for foreign residential purchases with regards to the exchange rate. “The dollar and the euro are already very high. There is serious buying advantage for foreigners, which results in a lot of interest. Turkish companies are also carrying out serious marketing activities abroad,” Erol noted.

The notorious ‘’Dr. Doom’’, Swiss investor Marc Faber is extremely bullish on investing in Turkey, basing his data on the fact that Turkish equities are tied to the US Dollar. Here is the full article.

America’s major issues for not being supportive of Turkey are based upon Turkey’s investments in natural gas resources from Iran, whom Trump has placed embargos and tariffs on, hoping the world will follow suit. In contrast, the Europeans have opted to stick to the agreement secured by Trump’s predecessor Obama, and Europeans also choose to maintain existing agreements.

Trump’s has another contention with Turkey regarding its purchase of anti-war missiles from Russia, and has added Turkey to the list of countries which it has imposed punishing tariffs at none-complying nations. Turkey is not the first to suffer; China and the EU recently reacted negatively to similar taxation actions from the USA.

Adding to the growing stand off between Turkey and the USA is the issue of the American pastor Andrew Brunson under house arrest in Turkey for alleged links to the Fetullah Gulen movement. While this is not a new event, America has now reissued demands by setting deadlines for his immediate release. Turkey has rebutted with due process, saying it must follow the legal procedures which could take years.

Movement in any financial markets is always an exciting opportunity, and Luxury Property Turkey is closely monitoring the daily currency and real estate trends. Traditionally, investors step back at the start of any crisis but are also absolutely the first to step in quickly as opportunities ignite the market. We expect that developers who have loans in foreign currency will start to drop prices leading to a new property boom. The adage ”Buy low – sell high” has never rung truer.

Prime residential and commercial locations on the Bodrum peninsula consistently attract well-to-do Turks as well as buyers from the CIS and GCC who are typically immune to geo -political interference so we expect continued investment as well as a sharp eye for bargains from these savvy investors.